Sales Tax

Tax on Your Purchases

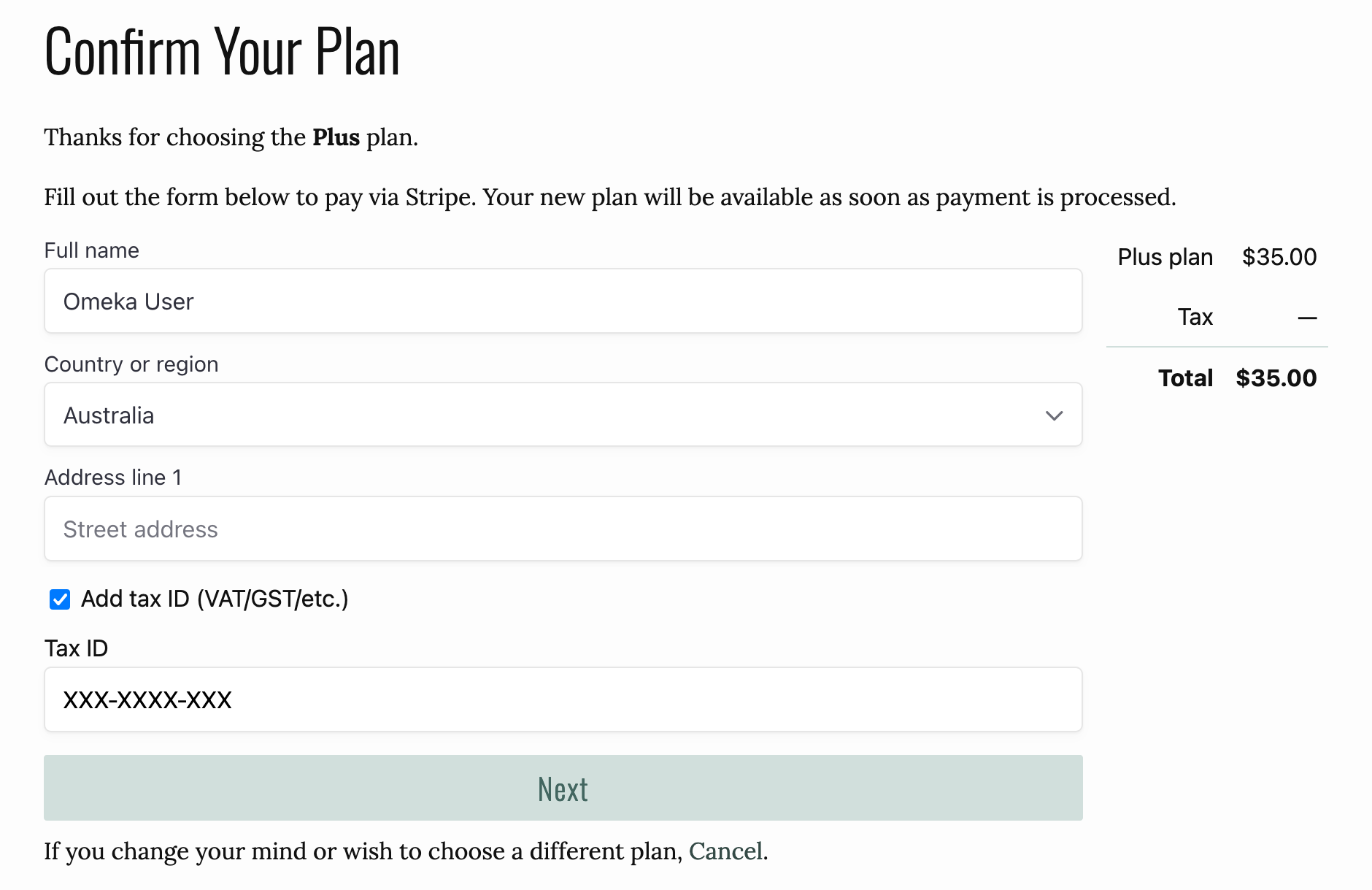

Omeka.net software as a service plans and add-ons are subject to consumption-based taxes in many jurisdictions. Depending on your location, this can appear as Value Added Tax (VAT), Goods & Services Tax (GST), or Consumption Tax (CT).

When you purchase an Omeka.net plan or service, you are charged the relevant tax based on your billing address.

The tax will be displayed as an independent line item on the checkout screen when you purchase, upgrade, or renew your plan.

Businesses Not Subject to Tax

Non-US tax-registered businesses may be exempt from paying consumption-based taxes. As a tax-registered business, please check the “Add tax ID” box to input a valid VAT or GST id and avoid being charged tax on your purchases. You will be charged tax if you have not entered tax details into our system.

EU-based users can check the VAT Information Exchange System (VIES) FAQ, which answers common questions. Users based in other locations should check their locale’s specific consumption-tax rules.

Other Tax-Exempt Customers

Some customers or organizations qualify to make sales tax-exempt purchases. Tax exemptions are granted at the state or country level. Please contact your tax advisor or your state or local taxing authority to determine if your organization qualifies for sales tax exemption.

If you have a valid tax exemption that you wish to apply to your Omeka.net purchases, you can contact us to submit your documentation.

Back to top